Financial Benefits that Employees Actually Want

7Newswire

17 Jun 2022, 21:21 GMT+10

Many workers' funds have been exhausted as a result of the COVID-19 outbreak and subsequent layoffs and cutbacks, resulting in increased financial constraints. Many people in the United States have lost their employment or know someone who has. Many of us are experiencing financial insecurity as a result of recent events.

Over time, financial stress has become more prevalent. According to a John Hancock poll, 49% of Americans are concerned about not having adequate retirement funds. Employer impact: 34% of employees spend at least some of their work time on personal finances. Employers should consider the psychological and physical effects that financial stress might have on their employees' productivity.

Employers normally have the option of providing financial wellness benefits on a voluntary basis. However, given the current state of affairs, many employees anticipate financial wellness programs to be included in their future employer's benefits package.

It's critical for employers to understand what financial wellness is and why it's vital. Employers may help their employees improve their financial health in a number of ways. Here are the top five financial wellness advantages that employees find the most enticing.

1. Options for Retirement Planning—With Matching Funds

Retirement is the most significant financial wellness benefit for employees, according to a research performed by SHRM and Morgan Stanley in June of this year. This is unsurprising, given that this is the conventional monetary bonus provided to employees.

Employees may find it simpler to save for their future if their employer offers a retirement plan. Employer-sponsored retirement plans assist workers bridge the financial knowledge gap and enhance their financial well-being. Employees can also save more easily with automated paycheck deductions.

Contribution-matching retirement plans take things a step further. They provide tax benefits to companies as well as improved recruiting and retention. Employees respect contribution matching as part of their complete pay package, which frequently leads to higher employee morale and loyalty. Contribution matching can potentially be used as a retention strategy, depending on how you implement a vesting timeline.

Employers are not required to make contributions to their workers' retirement plans. A contribution match, on the other hand, can be the answer if you're searching for a competitive edge in terms of recruiting and retention.

2. Insurance as a Safety Net

Employees seek safety net insurance as the second most essential financial wellness benefit, according to the same SHRM research. Many types of safety net insurance exist, but the most prevalent are life and disability insurance.

As workers lost family members or fell ill themselves as a result of the epidemic, safety net insurance became increasingly vital. Because this is a low-cost benefit for businesses, many already incorporate it in their financial wellness benefits. However, if you don't have one, it's worth thinking about based on how significant it is to your staff.

3. Obtaining Emergency Funds

This perk is the third most important among presently jobless Americans, according to SHRM data, which makes sense. According to a PwC poll conducted last year, 38 percent of workers had less than a thousand dollars in emergency savings.

As a result, you may have noticed commercials and new products that provide workers with payroll advances. Employers can also make these advances, but because they're essentially short-term loans, they require a financial agreement and must conform to specific restrictions. "However, because the employee has already worked for the money, they are less risky than a traditional loan", according to Andrew Cussens, the founder of Film Folk

Offering your staff an emergency savings account financed through payroll deductions can be a better alternative. These accounts may be set up and linked to a debit card just like any other savings account. Employees' wages are debited like a retirement account, but they may access their earnings anytime they choose without penalty. It just encourages employees to save even more in the event of an emergency.

4. Reimbursement of Expenses

While the foregoing financial wellness advantages are important to employees, there are other financial wellness benefits that might provide further peace of mind.

According to Eyal Pasternak, the founder of Liberty House Buying Group, "Financial stipends can help workers alleviate some of their financial difficulties." So, to flesh out your financial wellness offering and entice employees, consider adding one or more of these financial wellness benefits:

- Plans for paying tuition or repaying student loans

- Funds for caregivers or children's care

- Stipends for professional development

- Assistance with commuting

5. Financial Coaching and Planning

Finally, assisting employees in determining how much income or retirement savings they will require in the future might drive them to begin planning for retirement. Many employees lack the financial knowledge, resources, and tools needed to locate this data.

Consider working with financial advisors that may come to your place of business and speak with your employees about their financial requirements says Jason Porter, an investment manager at Scottish Heritage SG. They can teach you how to budget, save, invest, and pay off or manage debt.

When you supply any of the perks listed above, you'll need to educate people about the programs. Choose a benefits provider or HR partner that can help you with your benefits to make things easier.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Oakland Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Oakland Times.

More InformationUnited States

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

International

SectionTragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

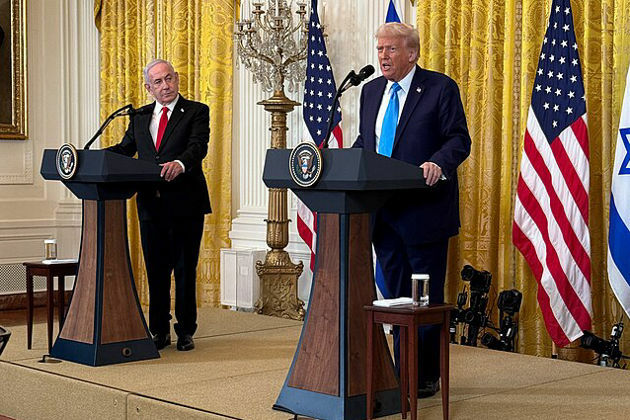

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...